IBM stock price continues to be a focal point for investors seeking opportunities in the tech sector. As one of the oldest and most reputable technology companies, International Business Machines Corporation (IBM) has a storied history that influences its stock performance. Understanding the dynamics behind IBM's stock price can help investors make informed decisions.

IBM has been a pioneer in the technology industry since its inception in 1911. Over the decades, it has evolved from manufacturing punch card tabulators to becoming a global leader in enterprise software, artificial intelligence, and cloud computing. This evolution has had a significant impact on its stock price, making it an intriguing subject for both long-term and short-term investors.

In this article, we will explore IBM stock price trends, factors affecting its performance, historical data, and future projections. Whether you're a beginner or an experienced investor, this guide aims to provide you with actionable insights to navigate the complexities of IBM's stock market journey.

Read also:188 Years Old Man Rescued The Extraordinary Story That Inspires Us All

Table of Contents

- IBM: A Historical Overview

- Analyzing IBM Stock Price Trends

- Factors Influencing IBM Stock Price

- IBM Financial Performance and Stock Price

- IBM Stock Price in the Tech Industry

- Investor Sentiment and IBM Stock Price

- Forecasting IBM Stock Price

- Risks Associated with IBM Stock Investment

- Investment Strategies for IBM Stock

- Conclusion and Next Steps

IBM: A Historical Overview

IBM, founded in 1911, has a rich history that spans over a century. Initially known as the Computing-Tabulating-Recording Company (CTR), IBM rebranded itself in 1924 to reflect its growing influence in the business world. Over the years, IBM has diversified its offerings, transitioning from hardware manufacturing to software and services.

IBM's transformation into a cloud and AI-focused company has played a pivotal role in its stock price performance. The company's commitment to innovation ensures it remains competitive in a rapidly evolving market.

Understanding IBM's historical milestones helps investors appreciate the factors that influence its stock price. For instance, the company's decision to divest its low-margin businesses and focus on high-value offerings has had a direct impact on its financial performance and stock valuation.

Key Historical Milestones

- 1911: Establishment as Computing-Tabulating-Recording Company (CTR).

- 1924: Rebranding to International Business Machines Corporation (IBM).

- 1960s: Launch of System/360, revolutionizing the computer industry.

- 2010s: Strategic pivot towards cloud computing and artificial intelligence.

Analyzing IBM Stock Price Trends

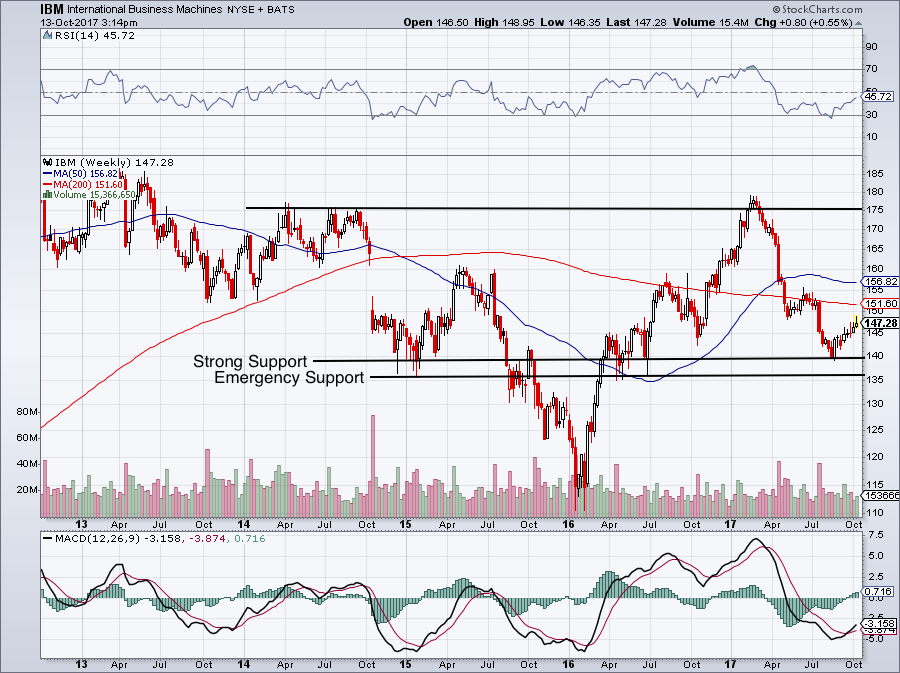

IBM stock price trends reveal a complex interplay of market forces, company performance, and global economic conditions. Over the past decade, IBM's stock price has experienced both highs and lows, reflecting the challenges and opportunities faced by the company.

In the early 2010s, IBM's stock price peaked as the company focused on high-margin businesses. However, the transition to cloud computing and AI required significant investments, temporarily affecting profitability and stock performance.

Recent years have seen a rebound in IBM's stock price, driven by its successful pivot to hybrid cloud and AI solutions. Investors are optimistic about the company's long-term growth prospects, especially in light of its strategic partnerships and acquisitions.

Read also:Grace Van Patten Rising Star In Hollywood

IBM Stock Price Trends: Key Insights

- 2013-2015: Stock price decline due to transition challenges.

- 2017-2020: Gradual recovery as cloud initiatives gain traction.

- 2021-Present: Stock price stabilization and growth driven by hybrid cloud strategy.

Factors Influencing IBM Stock Price

Several factors influence IBM stock price, ranging from internal company performance to external market conditions. Understanding these factors is crucial for making informed investment decisions.

Key factors affecting IBM stock price include:

- Revenue growth in cloud and AI segments.

- Profitability and cost management.

- Global economic conditions and market volatility.

- Technological advancements and competitive landscape.

IBM's ability to innovate and adapt to changing market demands has been a key driver of its stock price performance. The company's focus on high-value offerings ensures sustained growth, even in challenging economic environments.

Impact of Economic Conditions

Economic factors such as interest rates, inflation, and geopolitical tensions can significantly impact IBM stock price. For instance, during periods of economic uncertainty, investors may seek safer investments, affecting tech stocks like IBM.

IBM Financial Performance and Stock Price

IBM's financial performance directly correlates with its stock price. Quarterly earnings reports, revenue growth, and profit margins are critical indicators of the company's health and future prospects.

Recent financial highlights include:

- Revenue growth in cloud and AI segments.

- Improved profit margins through cost optimization.

- Strong cash flow generation supporting dividend payments.

Investors closely monitor these metrics to assess IBM's ability to deliver consistent returns. A strong financial performance often translates into a stable or increasing stock price, attracting more investors.

Financial Metrics to Watch

- Revenue growth rate.

- Operating margin.

- Free cash flow.

IBM Stock Price in the Tech Industry

In the highly competitive tech industry, IBM's stock price is often compared to its peers. Companies like Microsoft, Amazon, and Google dominate the cloud computing and AI space, making it challenging for IBM to stand out.

IBM's differentiation lies in its hybrid cloud strategy, offering enterprises a seamless transition from traditional IT infrastructure to cloud-based solutions. This approach resonates with large corporations seeking scalable and secure IT solutions.

Investors evaluating IBM stock price should consider its position in the tech landscape. While it may not match the valuation of larger tech giants, IBM's focus on enterprise solutions provides a unique value proposition.

Comparative Analysis

- IBM vs. Microsoft in cloud computing.

- IBM vs. Amazon Web Services (AWS) in scalability.

- IBM vs. Google in AI innovation.

Investor Sentiment and IBM Stock Price

Investor sentiment plays a crucial role in determining IBM stock price. Positive sentiment, driven by strong financial performance and strategic initiatives, can boost stock valuation. Conversely, negative sentiment, often fueled by market volatility or company-specific challenges, can lead to price declines.

Recent investor sentiment has been favorable, with analysts praising IBM's focus on high-value offerings. The company's commitment to dividend payments also enhances investor confidence, making it an attractive option for income-oriented investors.

Engaging with investor communities and staying updated on analyst reports can help gauge sentiment and make informed decisions about IBM stock price.

Measuring Investor Sentiment

- Analyst ratings and target prices.

- Social media and online forums.

- News articles and press releases.

Forecasting IBM Stock Price

Forecasting IBM stock price involves analyzing historical data, current trends, and future projections. While no prediction is foolproof, combining quantitative and qualitative data can provide valuable insights.

Key factors influencing future IBM stock price projections include:

- Continued growth in cloud and AI segments.

- Successful execution of strategic initiatives.

- Global economic recovery and market stability.

Investors should approach forecasts with caution, considering both bullish and bearish scenarios. Consulting multiple sources and maintaining a diversified portfolio can mitigate risks associated with stock price fluctuations.

Long-Term vs. Short-Term Projections

Long-term projections focus on IBM's ability to innovate and maintain its competitive edge. Short-term projections, on the other hand, are influenced by quarterly earnings, market sentiment, and macroeconomic factors.

Risks Associated with IBM Stock Investment

Investing in IBM stock comes with inherent risks, as with any stock. Understanding these risks can help investors manage expectations and make informed decisions.

Potential risks include:

- Intense competition in the tech industry.

- Fluctuations in global economic conditions.

- Execution risks related to strategic initiatives.

IBM's diversified portfolio and strong financial position mitigate some of these risks, but investors should remain vigilant and monitor developments closely.

Managing Investment Risks

- Diversify your portfolio across sectors.

- Set clear investment goals and risk tolerance levels.

- Stay informed about company and market developments.

Investment Strategies for IBM Stock

Developing a robust investment strategy is essential for maximizing returns on IBM stock. Whether you're a long-term investor or a short-term trader, understanding your goals and risk tolerance is key.

Popular investment strategies for IBM stock include:

- Buy-and-hold for long-term growth.

- Dividend reinvestment for income generation.

- Technical analysis for short-term trading opportunities.

Consulting financial advisors and conducting thorough research can help tailor a strategy that aligns with your investment objectives.

Implementing Your Strategy

Once you've chosen a strategy, consistently monitor its performance and make adjustments as needed. Regular reviews ensure your approach remains relevant and effective in a dynamic market environment.

Conclusion and Next Steps

In conclusion, IBM stock price reflects the company's rich history, strategic initiatives, and market position. By understanding the factors influencing its performance and implementing sound investment strategies, investors can capitalize on the opportunities IBM presents.

We encourage you to engage with the content by leaving comments, sharing your insights, or exploring related articles on our site. Staying informed and active in the investment community can enhance your decision-making process and lead to successful outcomes.

Remember, investing in IBM stock requires diligence and patience. Stay informed, diversify your portfolio, and consult trusted sources to navigate the ever-changing stock market landscape.