Student loan debt has become a significant financial burden for millions of people worldwide. Whether you're a recent graduate or someone who has carried this responsibility for years, understanding the repayment rules is crucial for managing your finances effectively. This guide will break down everything you need to know about student loan repayment, offering expert advice and actionable tips.

As tuition costs continue to rise, more students are relying on loans to fund their education. However, the repayment process can be overwhelming without proper guidance. By staying informed and proactive, you can navigate the complexities of student loans and work toward financial freedom.

In this article, we'll explore the latest rules, strategies, and resources to help you manage your student loan repayment successfully. Let's dive into the details and uncover the secrets to paying off your debt efficiently.

Read also:Nell Verlaque A Comprehensive Guide To Her Life Career And Achievements

Table of Contents

- Understanding Student Loan Basics

- Overview of Student Loan Repayment Plans

- Income-Driven Repayment Options

- Loan Consolidation and Refinancing

- Student Loan Forgiveness Programs

- Tax Implications of Student Loan Repayment

- Consequences of Loan Default

- Avoiding Student Loan Scams

- Tips for Successful Repayment

- Additional Resources and Support

Understanding Student Loan Basics

What Are Student Loans?

Student loans are financial aids designed to help students pay for their education-related expenses, including tuition, books, and living costs. These loans come in two primary forms: federal and private. Federal loans are funded by the government and typically offer lower interest rates and more flexible repayment options. Private loans, on the other hand, are provided by banks and financial institutions and often come with higher interest rates.

Understanding the differences between these types of loans is essential when planning your repayment strategy. Federal loans often include benefits such as income-driven repayment plans and loan forgiveness programs, which may not be available with private loans.

Overview of Student Loan Repayment Plans

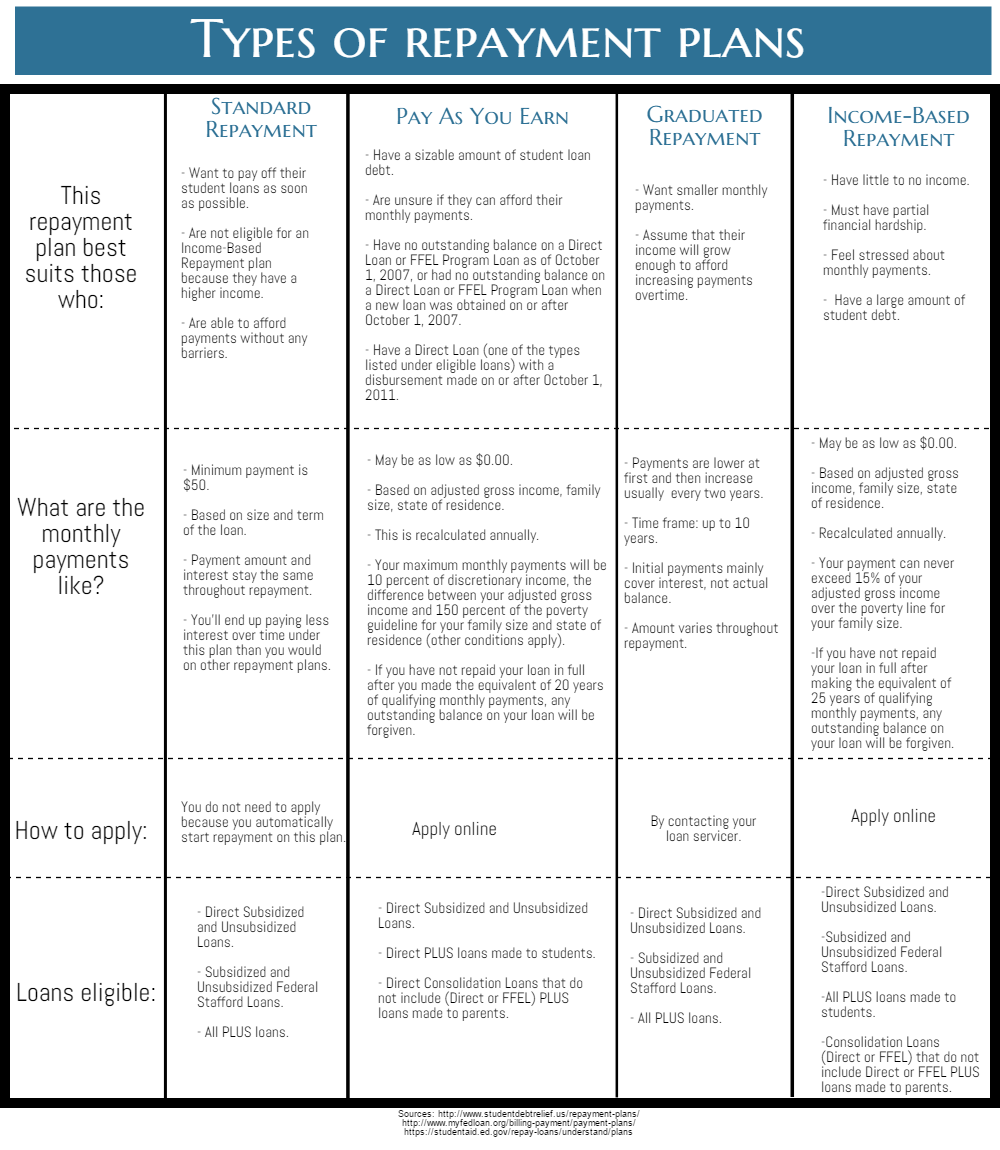

Once you graduate or leave school, you'll enter the repayment phase of your student loans. It's important to familiarize yourself with the available repayment plans to choose the one that best fits your financial situation.

- Standard Repayment Plan: Fixed monthly payments over 10 years.

- Graduated Repayment Plan: Payments start lower and increase every two years.

- Extended Repayment Plan: Extends the repayment period up to 25 years, reducing monthly payments.

Each plan has its advantages and disadvantages, so it's crucial to evaluate your options carefully. For example, while extending the repayment period may lower monthly payments, it can result in paying more interest over time.

Income-Driven Repayment Options

Eligibility and Benefits

Income-driven repayment (IDR) plans are designed to make student loan payments more manageable based on your income and family size. There are several IDR plans available, including:

- Income-Based Repayment (IBR)

- Pay As You Earn (PAYE)

- Revised Pay As You Earn (REPAYE)

- Income-Contingent Repayment (ICR)

These plans typically cap your monthly payments at a percentage of your discretionary income, making them an excellent option for borrowers facing financial hardship. Additionally, any remaining balance may be forgiven after 20-25 years of qualifying payments, depending on the plan.

Read also:Emily Armstrong A Rising Star In The Entertainment World

Loan Consolidation and Refinancing

Loan consolidation and refinancing are two strategies that can simplify your repayment process. Consolidation involves combining multiple federal loans into a single loan, resulting in one monthly payment. Refinancing, on the other hand, involves replacing your existing loans with a new loan, often with a lower interest rate.

While both options can reduce your monthly payments, it's important to weigh the pros and cons. For example, refinancing a federal loan with a private lender may result in losing access to federal benefits like income-driven repayment and loan forgiveness.

Student Loan Forgiveness Programs

Public Service Loan Forgiveness (PSLF)

Public Service Loan Forgiveness is a program designed to help borrowers working in public service sectors, such as government or nonprofit organizations. Under PSLF, your remaining loan balance may be forgiven after making 120 qualifying payments while employed full-time in an eligible position.

To qualify for PSLF, you must be enrolled in an income-driven repayment plan and ensure your loans are serviced by the Federal Direct Loan Program. It's essential to verify your eligibility and maintain accurate records throughout the repayment process.

Tax Implications of Student Loan Repayment

Student loan repayment can have significant tax implications, both positive and negative. For example, you may be eligible to deduct up to $2,500 of the interest paid on your student loans annually, reducing your taxable income. However, if your loans are forgiven, the forgiven amount may be considered taxable income, depending on the circumstances.

Consulting with a tax professional or financial advisor can help you navigate these complexities and ensure compliance with tax regulations.

Consequences of Loan Default

Defaulting on your student loans can have severe consequences, including wage garnishment, damage to your credit score, and loss of eligibility for federal benefits. If you're struggling to make payments, it's crucial to explore alternative options, such as deferment, forbearance, or switching to an income-driven repayment plan.

Contacting your loan servicer early and maintaining open communication can often lead to solutions that prevent default. Remember, defaulting on federal loans can lead to additional penalties, such as withholding of tax refunds or Social Security benefits.

Avoiding Student Loan Scams

Unfortunately, the rise in student loan debt has led to an increase in scams targeting borrowers. These scams often promise debt relief or forgiveness in exchange for upfront fees or personal information. To protect yourself, always verify the legitimacy of any company or program before sharing sensitive data.

Signs of a potential scam include:

- Requests for upfront fees

- Guaranteed loan forgiveness or consolidation

- Pressure to act immediately

- Lack of transparency about terms and conditions

Stick to trusted sources, such as the U.S. Department of Education or your loan servicer, for guidance on managing your student loans.

Tips for Successful Repayment

Creating a Budget and Sticking to It

One of the most effective strategies for successful student loan repayment is creating a budget and adhering to it. Start by listing all your monthly expenses and prioritizing essential payments, such as housing, utilities, and student loans. Look for areas where you can cut back and allocate those savings toward your loan payments.

Consider setting up automatic payments to ensure you never miss a deadline. Many lenders offer interest rate discounts for enrolling in automatic payment programs, further reducing your overall cost.

Additional Resources and Support

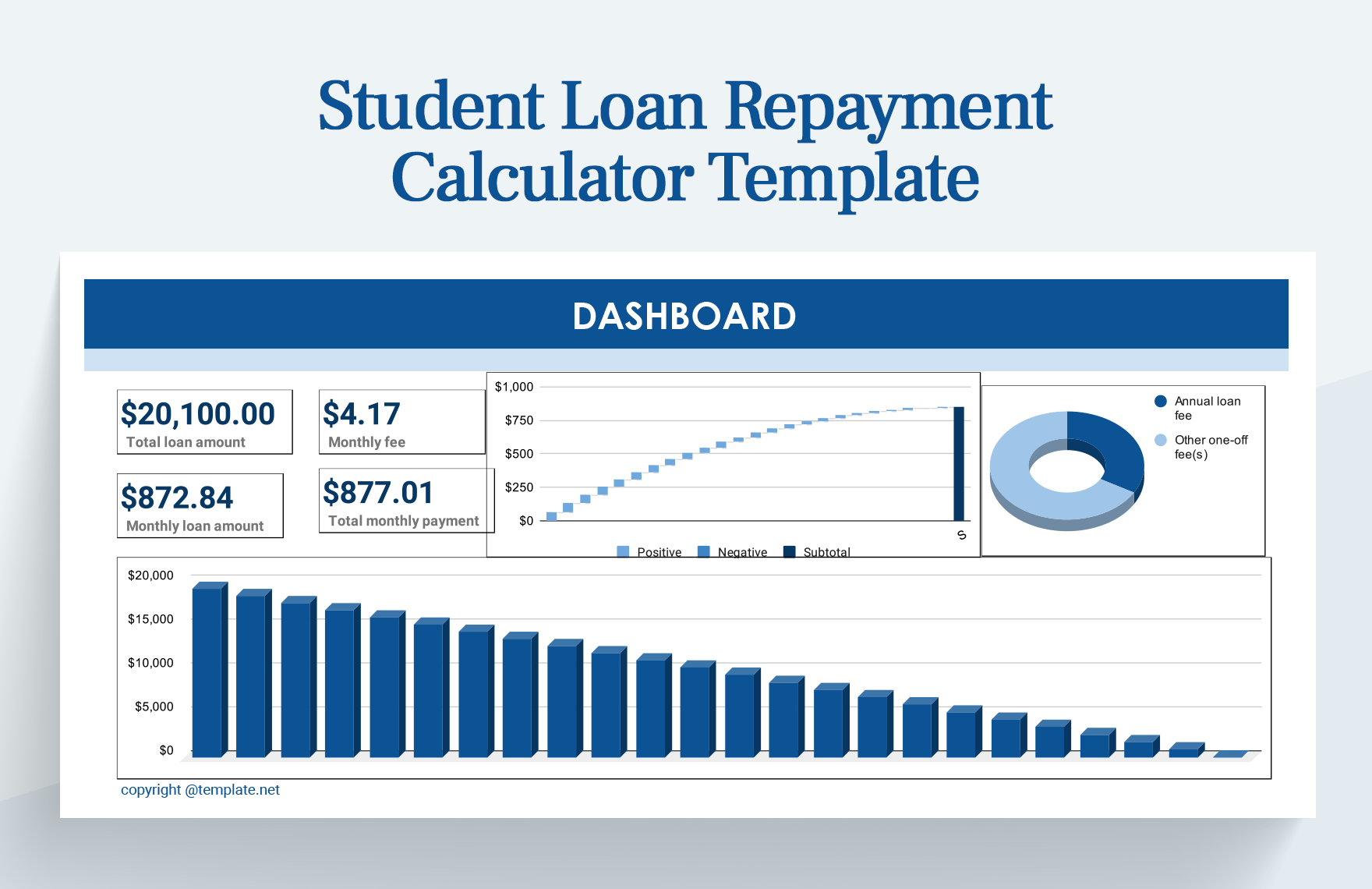

There are numerous resources available to help you navigate the complexities of student loan repayment. The U.S. Department of Education's website offers a wealth of information, including repayment calculators, eligibility tools, and contact details for loan servicers.

Nonprofit organizations like the National Foundation for Credit Counseling (NFCC) and Student Loan Borrower Assistance provide free counseling and support to borrowers in need. Taking advantage of these resources can empower you to make informed decisions about your financial future.

Kesimpulan

In conclusion, understanding student loan repayment rules is essential for managing your debt effectively and achieving financial stability. By exploring the various repayment plans, consolidation options, and forgiveness programs available, you can tailor a strategy that meets your unique needs.

We encourage you to take action today by reviewing your loan details, creating a budget, and reaching out to your loan servicer for guidance. Share this article with others who may benefit from the information, and explore our other resources for further support. Together, we can work toward a future free from the burden of student loan debt.

Remember, knowledge is power. Stay informed, stay proactive, and take control of your financial future!